Pre-file Form 2290 for Tax Year 2024-25

Pre-filing is the process of filing your Heavy Highway Vehicle Use Tax (HVUT) ahead of the 2290 filing season. Pre-filing 2290 form for tax period 2024-2025 will start on May 1st, 2024, and ends on June 30, 2024.

Pre-filing speeds up the acceptance of your e-filed 2290 return during the peak filing season when thousands of truckers rush to file their tax returns with the IRS.

However TruckTaxOnline.com would hold your tax returns filed through us and securely submit them to the IRS the moment they open for 2024-25, and deliver your schedule-1 copy to your e-mail address instantly.

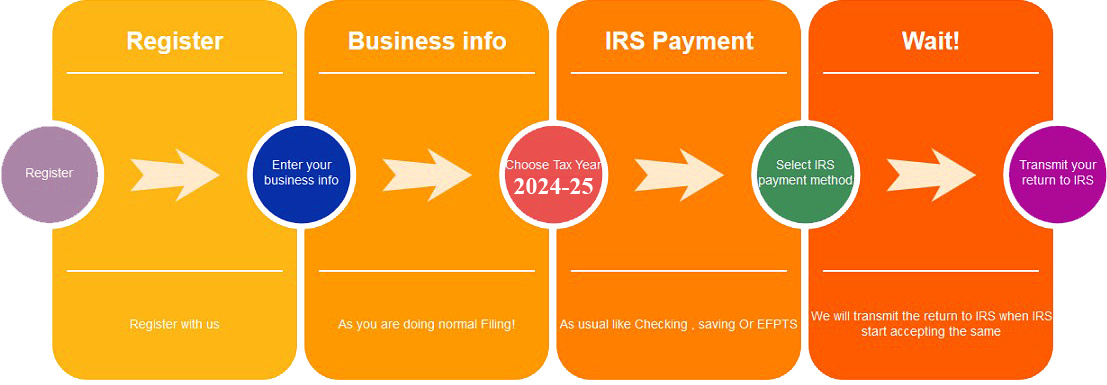

How it works?

| Start Form 2290 Filing |

Why should you pre-file form 2290?

Pre-filing or early filing of your IRS Form 2290 has several advantages:

- Pre-filing saves you time and helps you avoid the rush hour during peak filing season

- By filing early, you can steer clear of IRS penalties and late filing charges

- You will receive your IRS-stamped Schedule 1 copy before everyone else

- Even if your 2290 tax return gets rejected, you will be able to make corrections and retransmit it without incurring penalties

- You will get plenty of time to cross-check details, clarify doubts, and review your submission

- The IRS servers experience technical issues during peak filing season, which could delay the processing of your 2290 return. You can avoid such issues when you pre-file your form 2290

- Pre-filing allows you to plan ahead and collect the necessary information for filing your return

Before pre-filing form 2290, make sure that you have the following information ready:

- Business Name, Employer Identification Number (EIN) & Business address

- Tax period for which you are filing & First Used Month (FUM) of your vehicle

- Total number of vehicles being reported

- Vehicle Identification Number (VIN) & Taxable gross weight of your vehicle

- Mode of IRS tax payment

- Checking/Saving

- EFTPS

- Credit/Debit Card

Note:

Your submission for the Tax Year 2024-2025 will be processed after July 1st, 2024, when the IRS officially starts accepting returns and issuing Form 2290 Schedule 1 for the new filing year.

Contact Us:

e-mail : support@trucktaxonline.com

Phone : +1-615-601-3983 : +1-972-810-3393